Keeping Up With the Konglomerates: AT&T To Merge WarnerMedia, Discovery Into Potential Media PowerPlayer

On today's installment of Keeping Up with The Korporate Konglomerates, it may have taken more than four years, $84.5 billion dollars, and some serious beef with director Christopher Nolan over HBO Max's 2021 release plan, but phone company AT&T is apparently finally asking themselves the question we've all been wondering since 2016 – why the hell did they buy Warner Media?

In an act proving that buyers remorse isn't exclusive to accidentally snagging four large chocolate muffins only to realize upon first bite that the dark nibs you assumed were crafted from sugary cocoa were really just some sneaky f$@&%*! blueberries in disguise, AT&T announced on Monday that they would be combining WarnerMedia with Discovery to create a brand new media power player in the hopes of competing with streaming platforms like Netflix and Hulu, The Verge reported. Already approved by AT&T and Discovery's respective boards, regulators, who were notably conflicted on the initial merger, still have to sign off on the deal, which would combine the WarnerMedia catalog, which includes HBO, CNN, Cartoon Network, as well as the Harry Potter and Batman film franchises with Discovery's, which features HGTV, TLC, and Food Network. An “all-stock transaction,” according to the tech publication, if approved, the phone company will acquire “$43 billion in a combination of cash, debt securities, and debt retention on the part of WarnerMedia.” Meanwhile, those who own shares of AT&T “will receive stock worth 71 percent of the new company, while Discovery’s shareholders will own the remaining 29 percent.”

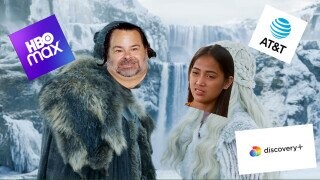

“It is super exciting to combine such historic brands, world class journalism and iconic franchises under one roof and unlock so much value and opportunity,” said David Zaslav, Discovery Communications CEO who is set to lead the still un-named new company, which will own both Discovery+ and HBO Max. “With a library of cherished IP, dynamite management teams and global expertise in every market in the world, we believe everyone wins.”

Don't Miss

Aside from legally paving the way for several truly cursed crossovers, including an inverted Breaking Amish where the Euphoria girls are sent away on a reverse rumspringa to learn how to churn butter and a 90 Day Fiance x Game of Thrones spinoff (which in all fairness may be the only way to eliminate the weird incest-y themes from that show), the pending deal also signifies a part of a larger trend of phone companies seemingly regretting their massive media purchases. Earlier this year, AT&T spun off DirecTV into its own company, and a few weeks ago, Verizon announced that AOL and Yahoo had been sold to a private equity firm for $5 billion, which is about half the amount for which they purchased the properties.

So folks, next time your phone company pressures you into buying a data plan or an ugly OtterBox case you don't really want, remember – hurt companies suffering from evident buyer's remorse hurt people by pressuring them into suffering from evident buyer's remorse.

For more internet nonsense, follow Carly on Instagram @HuntressThompson_ on TikTok @HuntressThompson_, and on Twitter @TennesAnyone.