5 Stupid BS Financial Things We Put Up With

DISCLAIMER: None of the following is to be taken as anything even approaching professional financial advice. It's simply the griping of a grumpy millennial who will probably die without ever owning property larger than a nice couch.

For a minuscule percentage of the population, their finances are something they enjoy looking at. They call their Swiss accountant every morning and say things like, "Read the numbers to me again, Quincy!" while chuckling over a mug of warm stem cells. These are also the people who pronounce it "FUH-nance."

For the rest of us, opening our checking account app feels similar to cranking a jack-in-the-box that pops out and tells you you're eating noodles this month. As if a number that controls your life wasn't stressful enough, the financial industry has also added a couple wrinkles over the year because we're filthy little piggies that deserve nothing but scraps.

Don't Miss

Now there's no shortage of financial BS that starts from the top, raining lukewarm piss all the way down, like the fact that the federal minimum wage hasn't increased in over 10 years while the cost of living has gone up by 20%. A wound that's particularly raw at the moment given that Congress chose to renew this mushroom stamp on the working class' forehead only days ago as of this writing.

However, along with the continuous kneecapping of anyone whose income level doesn't include a hidden safe in their study, sometimes it's the small, ignominious wounds that cause the most pain, the same way the pain of a papercut somehow puts a sharp knife to shame. Things that we just accept like ...

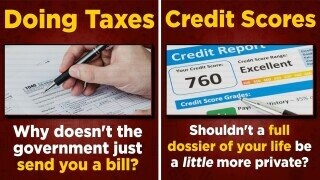

Modern Credit Scores Controling Everything

The credit score, for some reason, seems to have established itself as some sort of historical constant, despite the fact that the modern FICO credit score wasn't even established until 1989. Given the importance placed on it, you'd think the colonists showed up and started immediately issuing credit scores to the Native Americans along with their smallpox blankets. In reality, those numbers between 350-800 that decide pretty much anything you can do financially are probably younger than your parents.

Now, the general idea of a credit report has existed for a very long time, in a less controlled way. Lenders simply wanted a way to know how likely they were to get paid back, and Equifax, still around today, was founded in 1899. Across the country, you could also find local credit reporting agencies, I assume, with files that said things like "Known Rogue & Man Of Frivolous Nature! Do Not Lende!"

Inked Pixels/Shutterstock

This makes sense, with lenders overwhelmingly preferring to actually be paid back. However, they originally existed as detailed reports that could be referenced by commercial lenders and merchants, not literally anyone that's ever sold you a donut. This changed in 1989. There was a demand to distill credit reports into something more readable and efficient than basically very boring spy dossiers. Fair, Isaac, and Company (where FICO gets its name) developed an algorithm that could do just that, producing a 3-digit score between 350 and 800 that also seems to somehow always be laughing at you.

The original FICO score also served a stated purpose: to predict how likely a person was to repay a debt over 90 days late. But as with anything simple designed to fill a need, the immediate next thought was, "Hmm, how do we expand this into an impenetrable, ever-present empire." Which they did, adding specialized FICO scores for everything from car loans to mortgages. The Hydra continued to grow additional heads until becoming the beast we know today ... that for some reason requires me to keep a credit card I no longer use in a drawer because canceling it will drop my precious score.

These days, credit scores are pulled basically every time you want to use a restaurant's bathroom, and unfortunately, they're here to stay. The best any of us can do is to generally try to think of our credit score as an ill-tempered romantic partner and try to minimize what we do to send them flying off the rails.

Useless Interest Rates On Your "Savings" Accounts

Provided you're one of the few that can actually afford to put any significant money into your bank's savings account and aren't hopping from paycheck to paycheck like a series of precarious stones, you may have noticed the abysmal interest rate offered by most.

"But my mom/dad/the head of my orphanage always said to put money in my savings account? This seems... awful!" you might think. And you're not wrong. Back when your elders recommended that, savings accounts might have offered a legitimately helpful way to save.

Steve Lovegrove/Shutterstock

In fact, as recently as 2006, it wasn't uncommon for savings accounts to offer a 4-6% annual return. As of today, you're more likely to see a rate of 0.5%, which means you might outearn a savings account by doing a thorough change check on your couch cushions every month. At this point, savings accounts serve more as an organizational tool than a genuinely helpful financial option, with those seeking actual recognizable returns better off investing in index funds or even precious metals, like a high-tech Blackbeard.

So why are savings accounts, to use a financial term, such dogshit? The answer lies in a value known as the Federal Discount Rate. We'll get to that in a minute, but first, some insight on how banks set interest rates. See, banks can set any interest rate that they want. The reason they don't just set it at zero and tell you to piss off (though we're certainly approaching that) is that they want to incentivize you to store your money in their coffers versus the aforementioned stock market and/or stack of gold bullion in your closet. This is so they have the money to finance things like mortgages, which is how they make their money back.

The lower the mortgage rate and the volume of mortgages, the less wiggle room they have to make a profit. In 2006, before the housing crash (Boy, that thing was really bad, huh?), when people were taking out mortgages willy-nilly at rates of 7-8%, banks had no problem offering high interest on savings accounts, confident they'd make it back. Nowadays, millennials aren't exactly snapping up real estate (which is our fault, according to 50-year-old journalists), and even if they are, they can't afford those sorts of rates. More common interest rates are 4-5%.

Even so, that wouldn't fully explain dropping the rate to what is mathematically equal to "eat shit percent." The reason for that is the FDR, which is the rate that the Federal Reserve will lend money directly to banks. When the economy is bad, as for most of the lifetime of those under 30, the FDR is very low so that banks can borrow as much money as needed to keep those cogs turning.

Since 2016, the FDR has hovered around 1-2%. Currently, thanks to the pandemic, the rate is ... 0.25%. Meaning that banks can borrow money directly from the Federal Reserve and only payout that rate in interest. In layman's terms, why would banks shell out money into your filthy grubby hands when they can just borrow as much money as they want from the government that they barely have to pay back any interest on? They have also figured this out, and ... don't.

You may be thinking, if they can just borrow as much money as they want, doesn't that mean the dollar has a largely imagined value? Welcome to the world of hyperinflation, which we certainly don't have time to go into here, but it is very good news for Blackbeard and his currency-independent doubloons.

Miriam Doerr Martin Frommherz/Shutterstock

401(k) Replacing Pensions

Retirement plans at all seem like a luxury these days when it feels like the main occupation of the younger generation is three occupations. Millennials and Zoomers are lucky to get health insurance, much less realistic retirement options since Ublyft or Doormates or your employer of choice plans to ax you scot-free through their use of at-will employment as soon as you deliver a half-melted ice cream cone anyways.

If you do have a retirement plan, it's likely a 401k. The days of a traditional pension and a gold watch for your time are long gone. According to CNBC, only 13% of private-sector workers have a traditional pension.

So why should you care? Because 401ks expose you and your hopes of a cabin on Golden Pond to the stock market in a way that traditional pensions do not. Anyone living in America over the last decade or so should be rightly distrustful of putting their future in the hands of the stock market, and indeed, we saw in grim relief what can happen with the recession decimating the 401ks of many citizens and forcing your grandpa to work as a Walmart greeter into his 70s.

Why did 401ks become so popular then? Your first guess is probably right. It's cheaper for employers. In addition, when they were first introduced, it was the '80s, Americans were starry-eyed dreamers railing fat lines of cocaine and naivete, and they were told that the booming stock markets would make their dumb old pensions look like fat turds in a few years. Sure, if the stock market DIDN'T skyrocket their retirement funds would crash with it, but that's boring; here, have more cocaine!

Carol M. Highsmith/Picryl

Today, the people responsible for pioneering the 401k exhibit an Oppenheimer-like regret, saying things like "I was certainly not anticipating that it would be the primary way people would be accumulating money for retirement 30 plus years later." A quote from former American Society of Pension Actuaries head Gerald Facciani in this Wall Street Journal piece sums it up nicely: "The great lie is that the 401(k) was capable of replacing the old system of pensions."

Banks Being Closed On Weekends

If you're someone with an aggressive work schedule, you've likely experienced the pain associated with finally squeezing a bank visit into your calendar, only to hear a discouraging "clank" as you finally get to the door of the bank. Even today a huge amount of banks are closed on weekends, making it difficult for those who work many hours to get anything done in person.

Why is this? To be honest, it's not the most complicated reason: they don't want to, and they don't need to. Your local coffee shop wouldn't dream of closing on weekends, because the more people who come in, the more money they make. Banks don't need to be open to make money, and being open means they have to pay operating costs and wages (often at overtime rates).

ZDL/Shutterstock

It's something that probably wasn't as much cause for batted eyelashes as much in the past as today. Now, worker's rights are decimated, and the idea of a traditional five-day 9-to-5 workweek is about as common as a full-time blacksmith. Until there's a compelling reason for them to open, which has only dwindled with the emergence of ATMs and mobile banking apps, you're unlikely to get anywhere past those little ATM Magneto Jails anytime outside of M-F.

Having To Prepare Your Taxes

Yeah, it's annoying, but what's the alternative? How about this one: you just get sent your forms filled out, check them, and sign them if everything looks good. That's not only NOT a pipe dream; it's already currently how portions of Europe handle taxes. So if that's true, why do Americans continue to take a math exam where a failing grade results in committing a crime every year?

Proxima Studio/Shutterstock

Well, a big reason is because the people who help you take that exam have a pretty significant investment in keeping them complicated. Reporting from ProPublica shows that Intuit (of TurboTax) and H&R Block spent a combined $5 million in 2016 lobbying to prevent pre-filled returns from being offered to taxpayers. They then have the gall to pump out commercials starring an attractive 27-year-old from central casting that's never seen a W2 telling you about how they're here for YOU, to get you the MOST money from the big bad IRS because they are your FRIEND and they let you have half a bagel that one time, don't you remember?

If you're not aware, the IRS does offer a system called "Free File," which allows you to file your taxes for free ... through many companies, including Intuit and H&R Block. You could plot this scheme out on a board with three inches of red yarn and have two leftover. However, though Free File appears to be an olive branch to citizens, it's closer to the "good cop" offering you stale coffee, telling you how sorry they are about how Officer IRS treated you.

Even awareness of the Free File program is shockingly low, probably because none of the tax preparers have any interest in you finding out about it and because the government isn't exactly loquacious when it comes to telling citizens about programs that can help them.

Given that this article is coming out around tax time, absolutely look into FreeFile if you weren't already aware of it. If you have a fairly normal return, a.k.a. aren't enjoying the beloved gig economy, you're very likely able to file your return fairly easily and for free. Just remember it's table scraps while the company you're filing through has a room full of turkey legs.

Top image: Casper1774 Studio, Proxima Studio/Shutterstock